Home / Blog / Going for Gold – The Year in Review

Going for Gold – The Year in Review

Author: Sonia Turner, Sales & Marketing Manager

Published: 18th August 2022

The year in review.

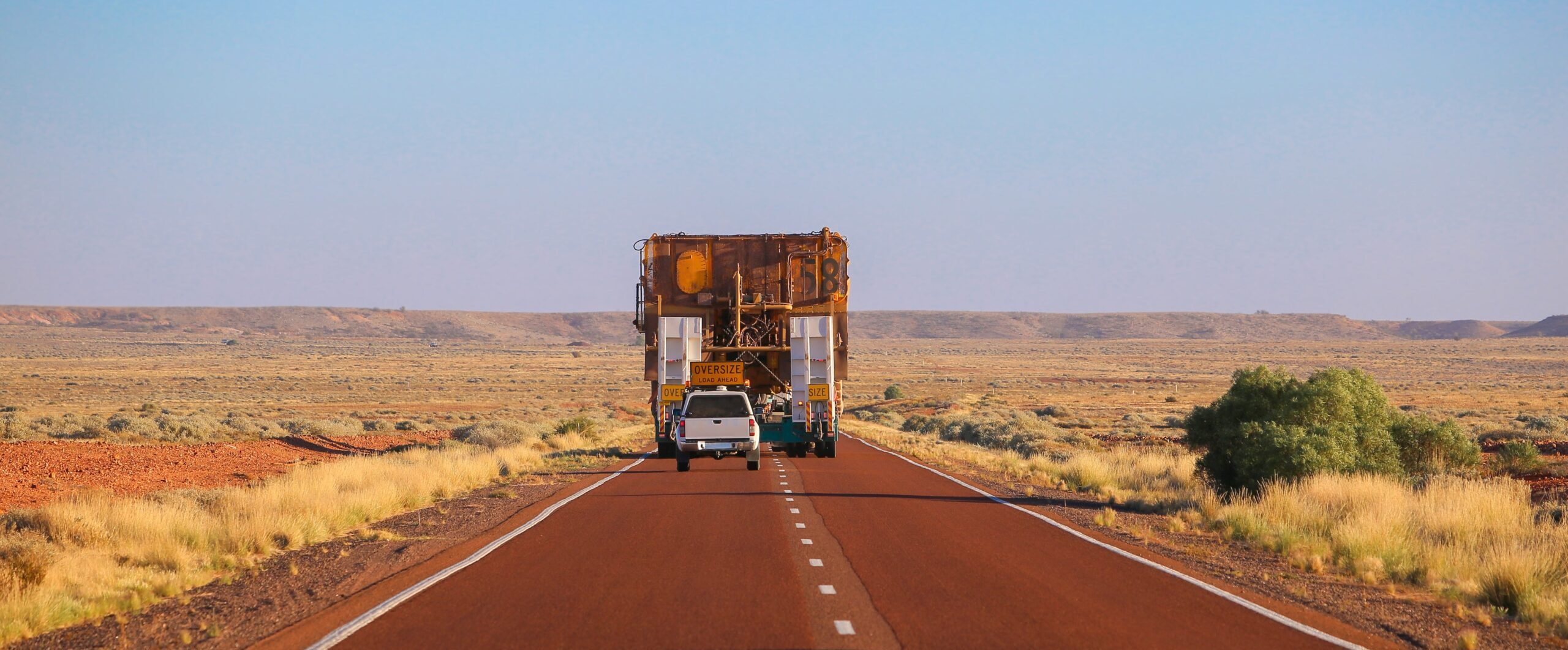

And so on to another year around the sun for the mining industry and time to reflect on the year that was, and the possibilities for the future.

As always the new financial year was brought in with the annual Diggers and Dealers event. Returned to its usual August time slot and what proved to be one of the largest attended, despite no interstate or international travellers allowed due to the WA COVID restrictions. It became very much a WA beat the drum fest, and inevitably gold was definitely in focus for much of the event.

Attendees and miners alike were in bullish mood and the presentations of Northern Star, Westgold and Gold Road did nothing to dampen the spirits and belief that we had come out of the pandemic strong and with a good year ahead of us.

And then we head into another wave. Companies taking a cautious approach continued with their working from home theme, despite the McGowan government finally lowering its boarders to let a full capacity crowd into the RIU conference.

The only issue this time is that we are now finally feeling the long COVID effects to the world economy of which we cannot hide. Escalating supply chain issues, labour shortages and driving inflation also started to come apparent. Banks indicate that recession has now begun to loom over our metals. News that there is economic slowdown in the US, and a possible recession in Europe, has triggered warnings from banks that industrial metal prices could fall steeply over the next six-to-nine months.

However, there is a commodity view that is not all pessimism. Gold, for example, is expected to find support as recession fears escalate.

“Central bank purchases (of gold) are likely to be strong as currencies depreciate and geopolitical risks rise,” says ANZ.

And this essentially agrees with Evolution Mining’s Jake Klein at this year’s Diggers & Dealers 2022 conference, with him tipping the gold price to reach $2,000 to $3,000 an ounce this time next year.

Argonaut has also suggested that Gold producers could also benefit from the market conditions. Despite June being a bumper month for exploration spend, advanced explorers have been left vulnerable. However, aggressive tactics could be an opportunity to consolidate and extend their portfolio of projects.

These same producers were also very positive about the labour shortage crisis. Many of the presenters at D&D22 seemed to be very optimistic. With the right culture and in part the right commodity, de-carbonisation metals seemingly attracting the new generation, then hiring should not be a problem.

We have a massive year ahead of us, with undoubtedly some volatility as we come to grips with the new normal of COVID variant waves. Global economies climbing out of their recessions and governments trying to curb inflation. The market leaders in use of industrial metals beginning to re-emerge and the new commodities really making their stamp to the future of battery metals. Not to mention the always safe harbour of gold.

It is going to be interesting to be a part of this industry that is mining.

Discover more.

24th January 2024

Entering a new year allows us to examine the top risks and opportunities that are top of mind for mining and metals industry executives in 2024. If you haven’t already read it, Ernst and Young's report - "Top 10 business risks and opportunities for mining and metals in 2024" has detailed breakdowns of the key industry trends.

Read More

6th October 2023

Scope Systems and PeopleTray Announce Strategic Partnership to accelerate the delivery of workforce management software to the mining and mining contracting market.

Read More

26th July 2023

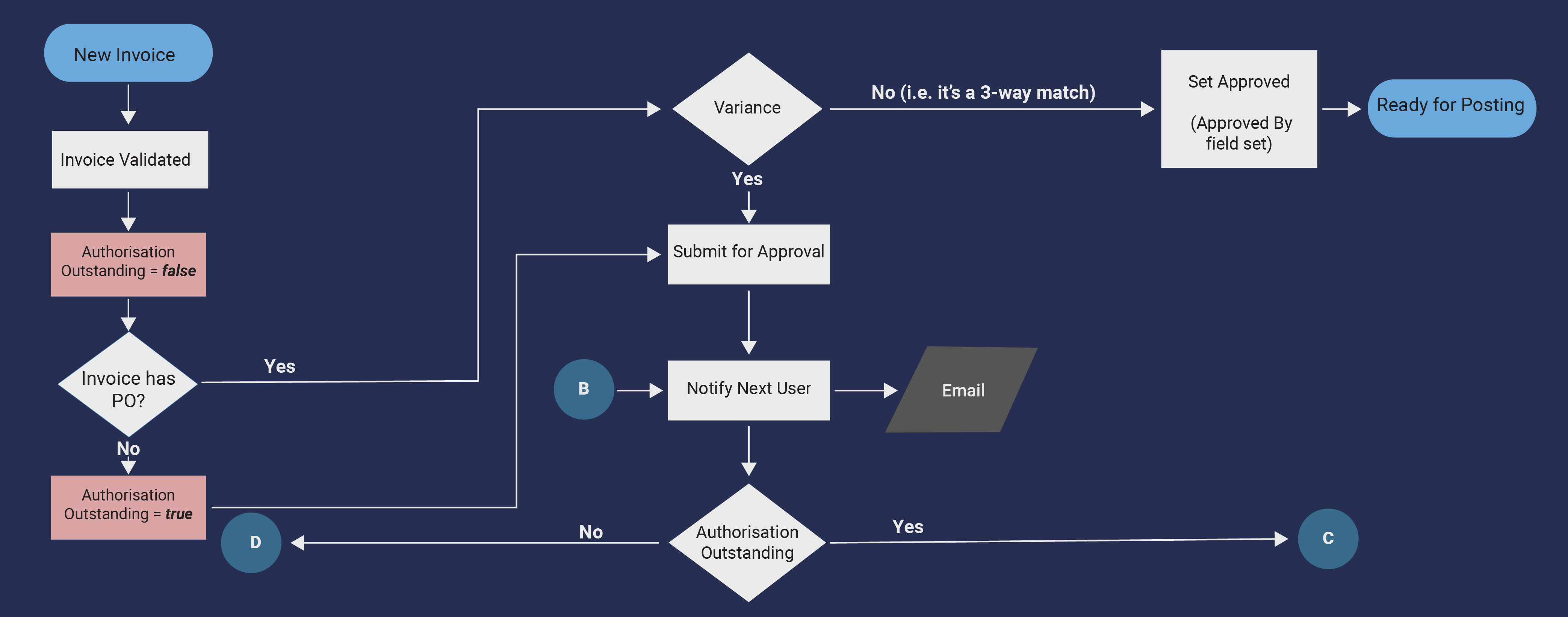

The Parked Supplier Invoice Approval System is a Pronto Xi enhancement created by Scope Systems that provides you with additional functionality by adding the ability to edit and include an approval process for invoices.

Read More

14th March 2023

The RIU Explorers conference this year saw a packed full house of over 1800 delegates and 200 exhibitors in the Esplanade Hotel, Fremantle. Both exhibitors and attendees there had a pretty bullish outlook, despite the repeated doom and gloom in the media.

Read More

29th November 2022

With staff retention a key issue currently facing the mining industry, discover why digital automation is key to increasing you workforce engagement.

Read More

13th October 2022

The mining industry has once again faced many challenges this year, with a major one again being the microscope the industry has been put under for its male-dominated culture. This year’s Australian Mining Risk Forecast has been recently released by KPMG and it’s an interesting read on what is top of mind for mining executives.

Read More

18th August 2022

Take a look at the year in review. From the RIU Explorers conference to Diggers and Dealers, our Sales and Marketing Manager Sonia Turner give her summary of the financial year.

Read More

8th August 2022

E-invoicing isn’t a new idea, the first electronic invoices were sent over 30 years ago through an electronic data interchange. Since then, e-invoicing has developed into a safe and secure way for suppliers to automatically and digitally exchange invoice information to customers through a secure network. So why move to e-invoicing and what are the benefits it can give to your company?

Read More

28th July 2022

Starting up an exploration venture requires careful planning of capital, with keeping costs to a minimum one of the highest priorities for a company. One aspect of keeping costs low can include the business systems designed to help control expenditure.

Read More

12th July 2022

Why partner with a software solutions specialist? Is it worth considering or are you better off managing on our own? To answer these questions, let’s look at what a specialist like Scope Systems can bring to the table.

Read More

28th June 2022

Companies today are more diverse then ever, finding they to have multiple software solutions to add extra functionality to their system. Having an integrated solution allows all your systems to 'talk' to each other , with your ERP acting as your primary system.

Read More

14th June 2022

For some companies, the idea of training staff to use new or existing software is a no brainer, recognising the benefits to the company from the outset. Others are more hesitant, with questions such as if there will be any tangible benefit, what will the true ROI be and what’s stopping staff jumping ship to another company after.

Read More

30th May 2022

From March 2022 a new domain name category has become available for Australian domain names, with the new, shorter .au name arriving.

Read More

24th May 2022

Budgeting is one of those unavoidable tasks that most of us would prefer not to do, investing in a budgeting solution can help improve your processes.

Read More

4th May 2022

A password is the first line of defence in protecting not only your own personal data, but also confidential company data. Check out our tips for creating a strong and memorable password.

Read More

19th April 2022

Are you ready for the upcoming reporting changes for STP Phase 2? Learn what you need to do now to prepare and what to expect.

Read More

5th April 2022

For data to be transformed into understandable information it first needs to be stored somewhere accessible, most commonly in a Data Warehouse or Data Lake.

Read More

28th March 2022

With accurate inventory data, you can measure supplier performance and help reduce extended lead times across your mining supply chain.

Read More

24th March 2022

Ensuring your multiple tenements activities are being recorded and reported on is vital, as failing to do so can affect your whole mining operation and lead to costly penalties.

Read More

14th March 2022

An inventory management solution will give mining companies data-driven insights to help increase profits by focusing on having the right stock to meet demand.

Read More

{"slides_column":1,"slides_scroll":1,"dots":"true","arrows":"true","autoplay":"true","autoplay_interval":2000,"speed":300,"lazyload":""}